São Paulo, Brazil – As floodwaters begin to recede in Brazil’s Rio Grande do Sul, the southernmost state which was ravaged by rains in May, claiming the lives of nearly 200 people and leaving thousands homeless, the financial toll of the destruction is just beginning to reveal itself.

According to preliminary data from the National Confederation of Insurers (CNseg), the financial impact of the climate disaster is estimated at R $1.7 billion (USD $330 million).

This figure is based on a survey carried out by the insurers confederation from April 28 to May 22, during which 23,441 claims were received by insurance companies, making it one of the largest insurance claim events in the country’s history.

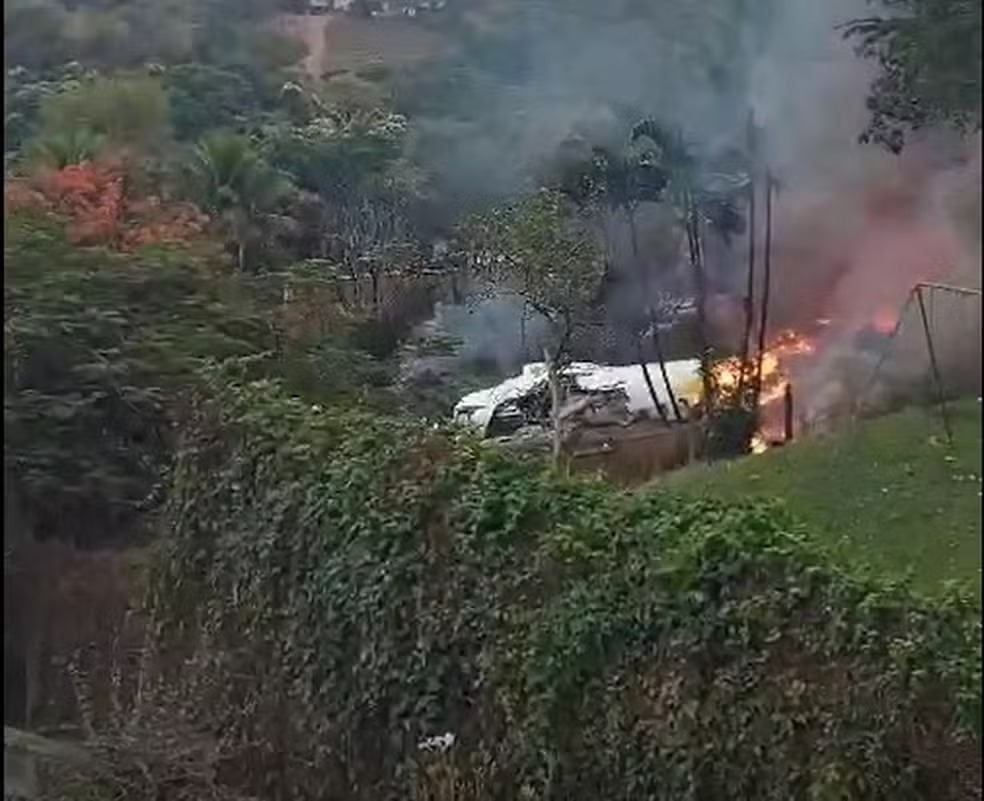

(Gustavo Mansur/Piratini Palace courtesy)

CNseg reported that thus far, auto insurance claims account for nearly 35% of all claims, totaling around R $557 million (USD $107 million).

Home insurance claims represent 48% of the total, with damages valued at R $293 million (USD $146 million). The rest of the registered requests refer to agricultural, corporate, business and infrastructure insurance.

In a virtual press conference, CNseg President Dyogo Oliveira indicated that these numbers are expected to rise significantly in the coming weeks as weather conditions improve, allowing daily life to gradually return to normal.

(Rafa Neddermeyer/Agência Brasil courtesy)

“At this moment, I believe a large portion of policyholders have not yet reported their claims or filed for indemnification. This is natural as people are still dealing with more pressing issues, focusing on survival and salvaging personal and sentimental belongings. Many will wait until things calm down to make notifications,” Oliveira said.

This perspective is supported by data. According to Bright Consulting, an automotive sector consultancy, around 200,000 vehicles were lost in the floods, including nearly 3,000 brand new units that were still on dealership lots.

(Mauricio Tonetto/Government of Rio Grande do Sul courtesy)

But despite the anticipated surge in indemnification requests, Oliveira assured that the insurance sector is fully prepared to meet customers’ needs.

“The entire insurance regulation system is designed to ensure that insurers have the necessary reserves to handle events like this. The Brazilian system is fully equipped, and insurers have sufficient resources to cope with this event. There will be no liquidity issues within the Brazilian insurance system,” Oliveira said.

The executive highlighted the sector’s resilience, noting that claims are being processed in an average of 48 hours, even amid the catastrophe. Many companies have streamlined their procedures, waiving inspections and retrieval of indemnified property. Additionally, CNseg has bolstered regulatory teams and formed dedicated groups to handle cases specifically from Rio Grande do Sul.

(Mauricio Tonetto/Government of Rio Grande do Sul courtesy)

For insurance companies, the floods in the southern part of the country are already deemed the largest compensation event in the sector’s history in Brazil. They believe that extreme weather episodes will become increasingly frequent and that is the reason why insurers are asking the public authorities for more planning to mitigate future damages.

“This event underscores the necessity for Brazil to organize better to handle these situations,” said Oliveira. “We need a more structured disaster prevention system, a more efficient disaster alert system. Our infrastructure needs to be more resilient, with construction prepared to withstand and react to such events, including anti-flood systems. We must rethink and restructure the height of bridges, the elevation of road embankments, and other infrastructure elements to cope with these challenges.”

(Rafa Neddermeyer/Agência Brasil courtesy)